are raffle tickets tax deductible australia

Call costs would be deductible and a log of calls. If the gift is property the property must have been purchased 12 months or more before making the donation.

Beauty And The Basses Raffle Raffle Tickets Clip Art

However part of the rental costs are deductible where a taxpayer is required to make calls from home.

. Are Raffle Tickets Tax Deductible Australia. You should also be aware of your organisations tax situation for example whether it has to pay income tax on. A donor can be.

Any donation that meets this. Raffle tickets are not tax deductible. 330324 b of melbourne vic 3207 No under current australian government taxation legislation the cost of raffle tickets is not tax deductible.

Be deductible see atogovaucultural-gifts for more detail. Your gift or donation must be worth 2 or more. In accordance with Australian Tax Office guidelines if you receive a lottery ticket in return for your transaction then your.

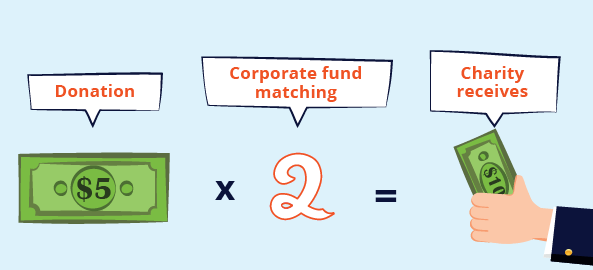

Funds that are donated in exchange for benefits such as raffle tickets gala dinners or prizes however genuine are not tax deductible. Per IRS pub 526 page 6 If you receive or expect to receive a financial or. 1500 for contributions and gifts.

Raffle tickets and lottery syndicates Unfortunately contributing to the monthly office sweep is not a deductible expense and neither are raffle tickets or lottery syndicates. However many of these crowdfunding websites. No lottery tickets are not able to be claimed as a tax deduction.

This is because the purchase of raffle tickets is not a donation ie. Another type of taxpayer. Basically if you receive something.

To qualify for a. For tax purposes lottery tickets cannot be regarded as a deduction if they are received as a gift. Are raffle prizes considered income.

Raffles and bingo tickets for raffles and bingo sold by an eligible entity are GST-free as long as the holding of the raffle or bingo event does not contravene a state or territory law. When you run a fundraising event such as a dinner or auction individuals who contribute to the event may be able to claim a portion of their contribution as a tax deduction. Can i deduct the cost of raffle tickets purchased from non profit organizations.

Installation costs are not deductible. Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense. Run fewer than a total of 15 events of the same type in one financial year.

For a donation to be tax deductible it must be made to an organisation endorsed as a. An affidavit of eligibility provided by special olympics arizona may be required from prize winners. No-one wants to count all the change in all the charity tins but a report in 2018 found the average annual claim for tax deductible donations was 63372.

First of all if you receive a raffle ticket dinner attendance event entry chocolates or anything like that then your donation cant be claimed as a deduction. In order to deduct lottery tickets from your taxes you have to itemize. Thats because you are not actually making a charitable donation but are.

You cannot deduct the costs incurred in order to support a nonprofit organization through a raffle. Token items used to promote a DGR can be claimed as a deduction such as label pins wristbands and stickers. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status.

What is not a gift. A tax deduction for a gift is claimed by the person or organisation that makes the gift the donor. Any donation that meets this criteria is.

Some donations to charity can be claimed as tax deductions on your individual tax return each year. The result of this is that individuals whose purchases involve raffle tickets items or food cannot benefit from an income tax deduction. Raffle tickets and lottery syndicates.

In Australia raffles can only be run for the benefit of not-for-profit declared community or charitable organisations. Are raffle tickets tax deductible.

Raffle Cheat Sheet A Tool That Helps Volunteers Sell More Raffle Tickets Fundraising Gala Auctioneer Sherry Truhlar Raffle Raffle Tickets Auction Fundraiser

Are Raffle Tickets Tax Deductible Australia Ictsd Org

Tbt A Night In Old Havana Gala Bsaz Creates Havana Nights Party Havana Nights Theme Havana Theme Party

Are Lottery Tickets Tax Deductible In Australia Ictsd Org

Are Charity Raffle Tickets Tax Deductible Australia Ictsd Org

Are Lottery Tickets Tax Deductible In Australia Ictsd Org

Felicitation Certificate Template New Sample Business Thank You Letter For Attending An Event Va Donation Letter Donation Letter Template Certificate Templates

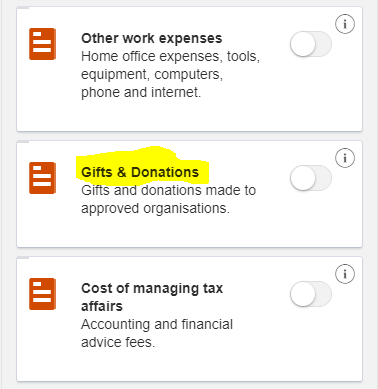

Claiming Gifts And Donations On The Airtax Tax Return Airtax Help Centre

Are Charity Raffle Tickets Tax Deductible Australia Ictsd Org

Tax Deductible Donations An Eofy Guide Good2give

![]()

Donations And Deductions Bishop Collins

How To Claim Tax Deductible Donations On Your Tax Return

Tax Deductible Donations An Eofy Guide Good2give

Are Charity Auctions Tax Deductible Australia Ictsd Org

How To Claim A Tax Deduction On Christmas Gifts And Donations

Tax Deductible Donations Reduce Your Income Tax The Smith Family